Invest with a robo advisor today

Moneyfarm has built a better way to protect and grow your money for your family’s future.

Low-cost robo advice that makes investing simple.

Low-cost robo advice that makes investing simple.

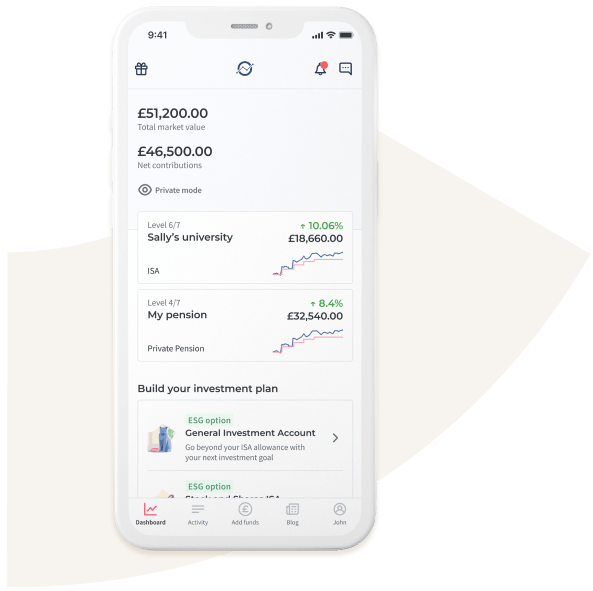

Be confident with easy-access investing on the Moneyfarm app.

More than 80,000 investors

£2.2bn invested

With investing, your capital is at risk

The robo advisor that's more than just a machine

Get £200 cashback when you invest in any Moneyfarm product*

Regulated

Moneyfarm is authorised and regulated by the UK Financial Conduct Authority (FCA).

Find Out More

Protected

Moneyfarm boasts M&G among its main investors. Your investments and capital remain separate from ours and are always protected by Saxo Bank.

Regulated

Moneyfarm is authorized and regulated by the UK Financial Conduct Authority (FCA). Find Out More.

Protected

Moneyfarm boasts M&G among its main investors. Your investments and capital remain separate from ours and are always protected by Saxo Bank.

Why should you invest with a robo advisor?

Why should you invest with a robo advisor?

You know you need to protect your money and grow it for the future, but feel locked out of the traditional wealth management industry by its high fees and complexity. Don’t worry, you’re not alone.

Financial services shouldn’t be reserved just for those that have the money to decode it. Financial security is important in an era when we’re getting older but saving less.

We’re proud to disrupt this traditional industry, by making low cost, efficient and transparent financial services an option for every family that needs it.

Our investment strategyNot ready to invest yet?

Try Liquidity+

Our new low-risk investment solution

1. Limited risk exposure: Invest in a range of low-risk money market funds, designed and monitored by our Asset Allocation team.

2. Consistent returns: Enjoy a gross annualised yield currently above 5%*, allowing you to get more from your savings.

3. Instant liquidity: Designed for short-term time horizons, with the freedom to exit or transfer your funds at any time.

Discover Liquidity+As with all investing, your capital is at risk. Returns are sensitive to the Bank of England’s deposit rate fluctuations, with lower rates leading to lower yields and higher rates leading to higher yields.

*Based on the weighted average of the gross yields regularly published by the money markets funds held in Liquidity+, as of 24th August 2023.

Why investors choose robo advice instead of DIY

Simple

We strip out the complexity of the traditional wealth management industry, so you’re confident your investments will help you achieve your financial goals.

Matching your investments to you

After matching you to an investor profile, our experts manage your portfolio and regularly rebalance to keep you on track with your goals.

Find out about our investment strategy.

Cost-effective diversification

Diversification is an effective way to manage risk, but can be hard and expensive to get right if you’re doing it yourself. We handle this for you.

Clear fee structure

A clear and low-cost fee structure means you keep more of your money, and there’ll be no hidden fund charges around the corner.

Find out about our pricing structure.

Flexibility

We invest in Exchange Traded Funds (ETFs), which means they can be bought and sold quickly. This adds flexibility to your portfolios and means you can get your money in five working days – for when life throws you a curveball.

A human touch

We employ a perfect blend of technology and human expertise to manage our clients’ portfolios. Enjoy guidance from a qualified, dedicated consultant at no extra cost when you invest with us. You can book your free initial consultation here.

Start investing with Moneyfarm

Cost-efficient investment consultancy and fully-managed portfolios to help you reach your goals, with an investment consultant at the end of the phone.

Start today