Unlock your wealth potential with our General Investment Account.

Professional management, personalised investment strategies, and expert consultants by your side.

Get started

Unlock your wealth potential with our General Investment Account.

Professional management, personalised investment strategies, and expert consultants by your side.

Get startedEnjoy limitless investing, your way.

Discover the key benefits of our General Investment Account:

Unlimited investment potential

No caps on how much you can invest.

Flexible portfolio options

Choose a Managed GIA to benefit fully from our expertise, or build and manage your own portfolio with a DIY GIA.

Expert guidance

Our dedicated consultants can guide and support you throughout your investing journey at no extra cost.

Enjoy limitless investing, your way.

Discover the key benefits of our General Investment Account:

No caps on how much you can invest.

Choose a Managed GIA to benefit fully from our expertise, or build and manage your own portfolio with a DIY GIA.

Our dedicated consultants can guide and support you throughout your investing journey at no extra cost.

All your pension wealth under one roof.

You’ve used up your tax-free ISA allowance and want to invest without limits.

You’re comfortable to invest subject to tax on any gains above your tax-free allowance.

You want the choice and flexibility to build your own portfolio

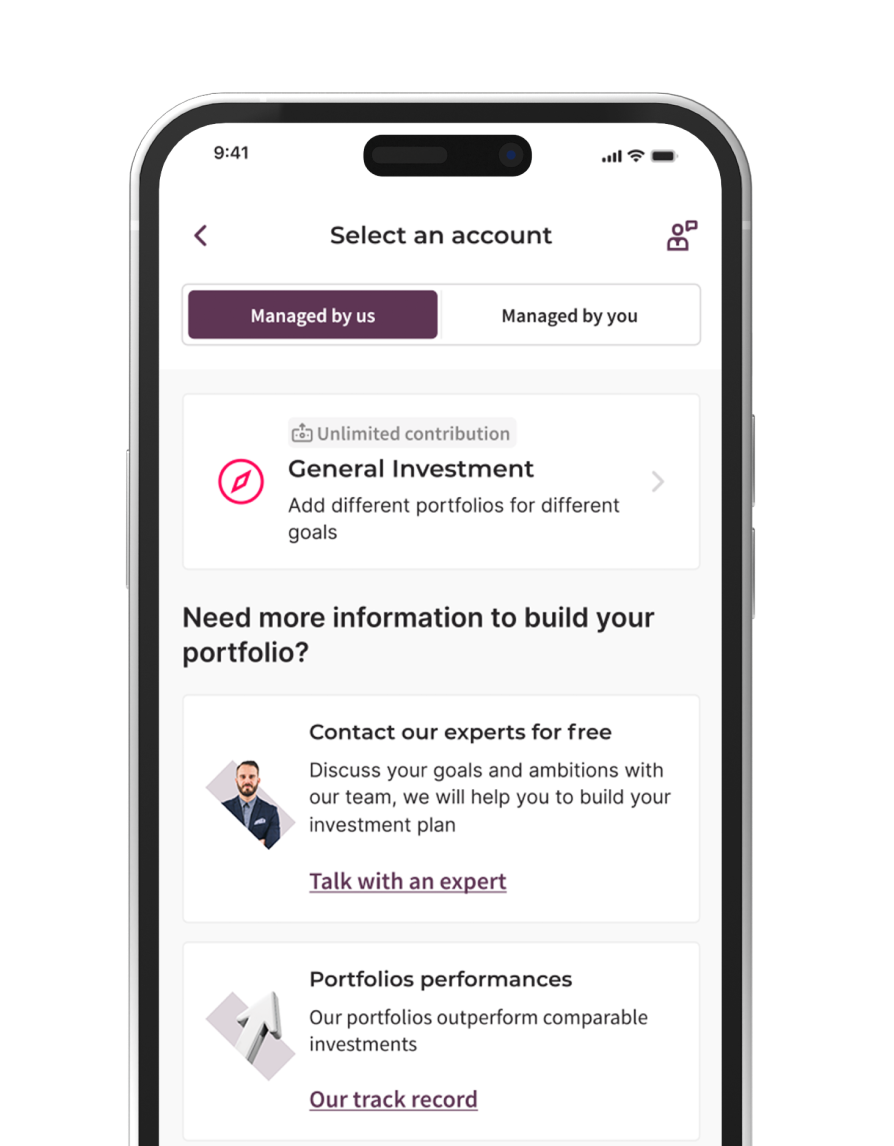

A General Investment Account to suit you.

Choose a Managed GIA if you want our experts to guide you through the portfolio creation process and manage your investments for you. Choose a DIY GIA if you want to choose your own investments and self-manage your portfolio.

A General Investment Account to suit you.

Choose a Managed GIA if you want our experts to guide you through the portfolio creation process and manage your investments for you. Choose a DIY GIA if you want to choose your own investments and self-manage your portfolio.

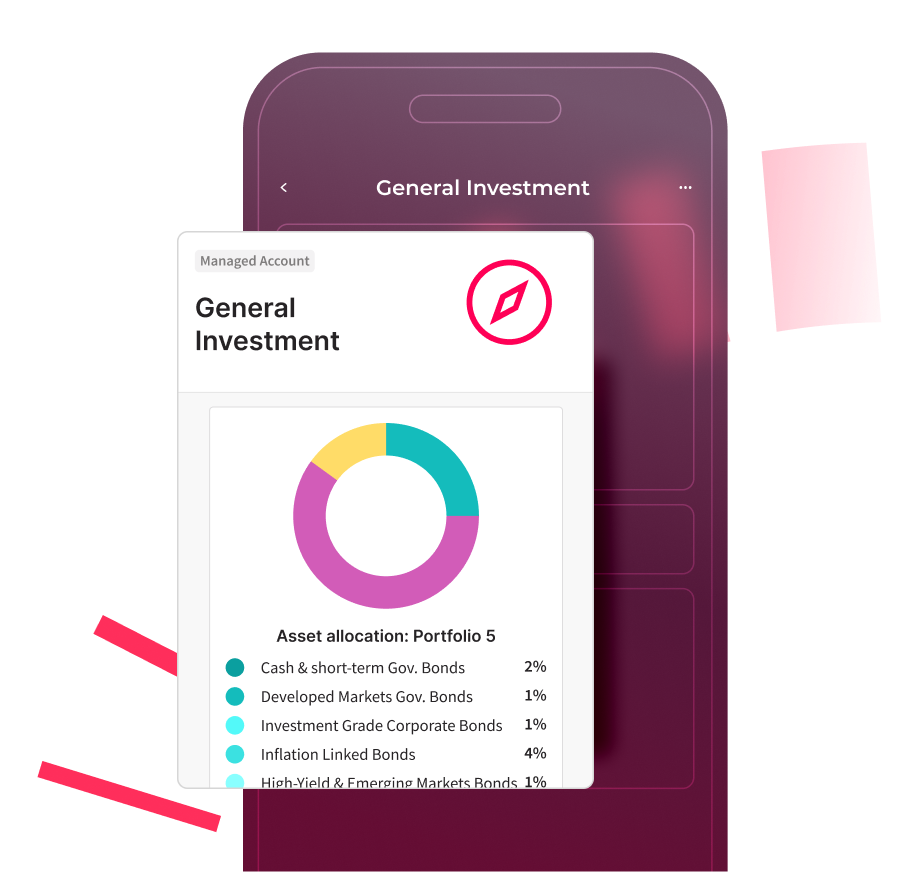

- Matched to you

Get matched with an expertly built, fully managed, ready-to-go portfolio. Or for a simpler, low-cost approach, choose a fixed allocation portfolio. - Enhanced strategies

Level up your Moneyfarm experience with different investing strategies – ESG, Thematic Investing, or Liquidity+, our smart, short-term investment solution. - Experts at your side

Our dedicated consultants are available at your disposal, ensuring you achieve your investment goals with confidence. - Transparent pricing

Enjoy simple, clear and transparent fees. Set up your portfolio for free. Learn more

- Direct market access

Choose from 1,000+ assets including stocks, ETFs, bonds, and mutual funds. - Guided investment experience

Shape your strategy backed by our team’s market insights and experience. Discover investment themes with our curated asset collections. - Personalise your portfolio

Create a portfolio in line with your values and goals, one investment at a time. All with a comprehensive view of your investments for effective decision-making. - Free to open an account

Set up your DIY GIA portfolio for free and get started in no time.

Our expertise powers your investing journey.

Our investment experts use in-depth research and advanced data analysis to provide you with valuable insights and market updates. These resources empower you to make well-informed decisions, aligning your investment choices with your wealth goals.

Plus, our dedicated consultants can guide and support you throughout your investing journey at no extra cost.

What our clients say about us.

Trust is earned, not given. If you’re still unsure about Moneyfarm, discover what our clients are saying about us on Trustpilot.

Our costs.

What you’ll pay

Total estimated costs

As your wealth grows, the Moneyfarm fee can reduce to 0.35%.

More on fees

How our portfolios have performed.

Explore the performance of our portfolios over time. View overall trends and the performance for specific years.

Key to the figures

Moneyfarm returns net of fees since inception (01/01/2016) vs. average peer group performance over the same time period. These past performance figures are simulated. Past performance is no indicator of future performance. The allocations shown above are based on our model portfolios at a point in time, so they’re an illustration of how your actual portfolio might look. The exact composition may differ, if the value of your portfolio falls below c. £3,000.

The chart shows a projection of the future value of the portfolio based on the expected return for each risk level taking into consideration the expected volatility to calculate more and less likely scenarios. Projections are not a reliable indicator of future performance, and are intended as an aid to decision-making, not as a guarantee. The projection includes the effect of fees, assumes income is reinvested and does not take into account the effects of inflation or tax. As with all investments, the value may go down as well as up, and you may not get back the full amount you invested.

Get started in 3 simple steps.

On your own or with help from one of our consultants.

Choose an investment solution or let our questionnaire guide you.

Discover the option best suited to your objectives and needs.

Start your investing journey with our experts by your side.

Choose an investment solution or let our questionnaire guide you.

Discover the option best suited to your objectives and needs.

Start your investing journey with our experts by your side.