Junior Stocks and Shares ISA.

Give your child the financial head start they deserve with our expertly managed Junior ISA (JISA). Invest up to £9,000 a year with tax-free returns until your child turns 18.

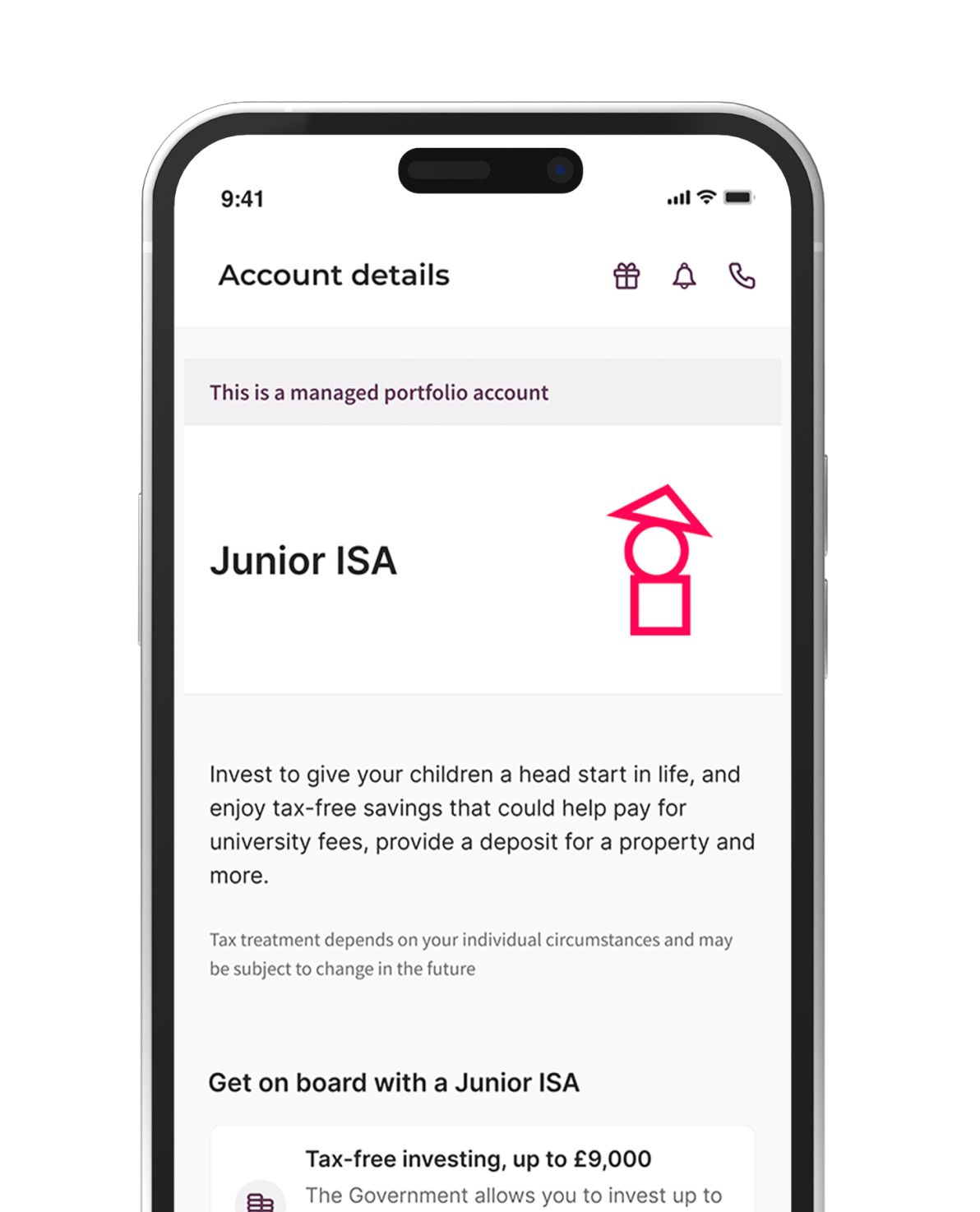

Junior ISA.

Unlock the full potential of your wealth with a Managed Stocks & Shares ISA. Our investment experts manage and monitor your investments, giving your wealth the best chance to grow.

Get startedTransfer a JISAWhat is a Junior ISA?

A Junior Stocks and Shares ISA is a tax-efficient investment account designed to help you invest for a child’s future. Instead of simply putting money aside in a Cash Junior ISA, a Junior Stocks and Shares ISA invests in a wide range of assets—giving you the potential for higher long-term growth, all under the annual tax-free allowance. By opening one on behalf of a child under 18, you’re harnessing the power of compounding to build a nest egg they can access, tax-free, at 18.

Why choose a Junior ISA?

Give your child a big financial head start

The earlier you invest, the more time you give their wealth the chance to grow.

Tax-free investing

Build their wealth tax-efficiently with a £9,000 tax-free allowance every year.

Socially responsible

Opt for a socially responsible JISA with investments that support a positive impact on society and the planet.

Gift contributions

Allow family and friends to contribute to your child's financial future.

Free transfers

Easily transfer existing Child Trust Funds or other JISAs to Moneyfarm.

Why Choose a Junior ISA?

The earlier you invest, the more time you give their wealth the chance to grow.

Build their wealth tax-efficiently with a £9,000 tax-free allowance every year.

Opt for a socially responsible JISA with investments that support a positive impact on society and the planet.

Allow family and friends to contribute to your child's financial future.

Easily transfer existing Child Trust Funds or other JISAs to Moneyfarm.

A Junior ISA could be right for you if…

You want to save or invest for a child’s future in a tax-efficient way

You’re comfortable with the money being locked away until the child turns 18

You want flexibility in how much you contribute, from small amounts to larger sums

You’re interested in potential higher returns through stock market investments

You want to involve family and friends in contributing to the child’s future

Our costs.

What you’ll pay

Total estimated costs

As your wealth grows, the Moneyfarm fee can reduce to 0.35%.

More on fees

How our portfolios have performed.

Explore the performance of our portfolios over time. View overall trends and the performance for specific years.

Key to the figures

Moneyfarm returns net of fees since inception (01/01/2016) vs. average peer group performance over the same time period. These past performance figures are simulated. Past performance is no indicator of future performance. The allocations shown above are based on our model portfolios at a point in time, so they’re an illustration of how your actual portfolio might look. The exact composition may differ, if the value of your portfolio falls below c. £3,000.

The chart shows a projection of the future value of the portfolio based on the expected return for each risk level taking into consideration the expected volatility to calculate more and less likely scenarios. Projections are not a reliable indicator of future performance, and are intended as an aid to decision-making, not as a guarantee. The projection includes the effect of fees, assumes income is reinvested and does not take into account the effects of inflation or tax. As with all investments, the value may go down as well as up, and you may not get back the full amount you invested.

Our experts are by your side.

Our dedicated consultants can guide and support you throughout your investing journey at no extra cost.

Book appointmentBook an appointment

Get started in 3 simple steps.

On your own or with help from one of our consultants.

Choose an investment solution or let our questionnaire guide you.

Discover the option best suited to your objectives and needs.

Start your investing journey with our experts by your side.

Choose an investment solution or let our questionnaire guide you.

Discover the option best suited to your objectives and needs.

Start your investing journey with our experts by your side.