We show your portfolio performance in two different ways and you can toggle between them, called “time-weighted” and “money-weighted” performance.

Time-weighted rate of return (TWRR) tells the performance of your investments over time. It is used to compare the investment returns as it removes the distorting effects of cash inflows and outflows, even as you regularly contribute to your account.

The money-weighted rate of return includes individual cash flows within a period to give an accurate reflection of the return you receive as an individual. We believe this gives you an accurate picture of the true return you received, accounting for your individual cash flows – these could be dividends, account top-ups or disinvestments. If you were to invest – or disinvest – an amount from your portfolio, this impacts the performance number. You can think of this as your portfolio’s “personal performance”. This measure of performance corresponds to a well-known concept called the internal rate of return (IRR).

Customers often confuse these with a “simple return” calculation, which would be found by just dividing your current value by your net contributions, and over time it will be less helpful as every time you invest you will reduce your performance.

All three measures are in theory the same if you only have one cashflow.

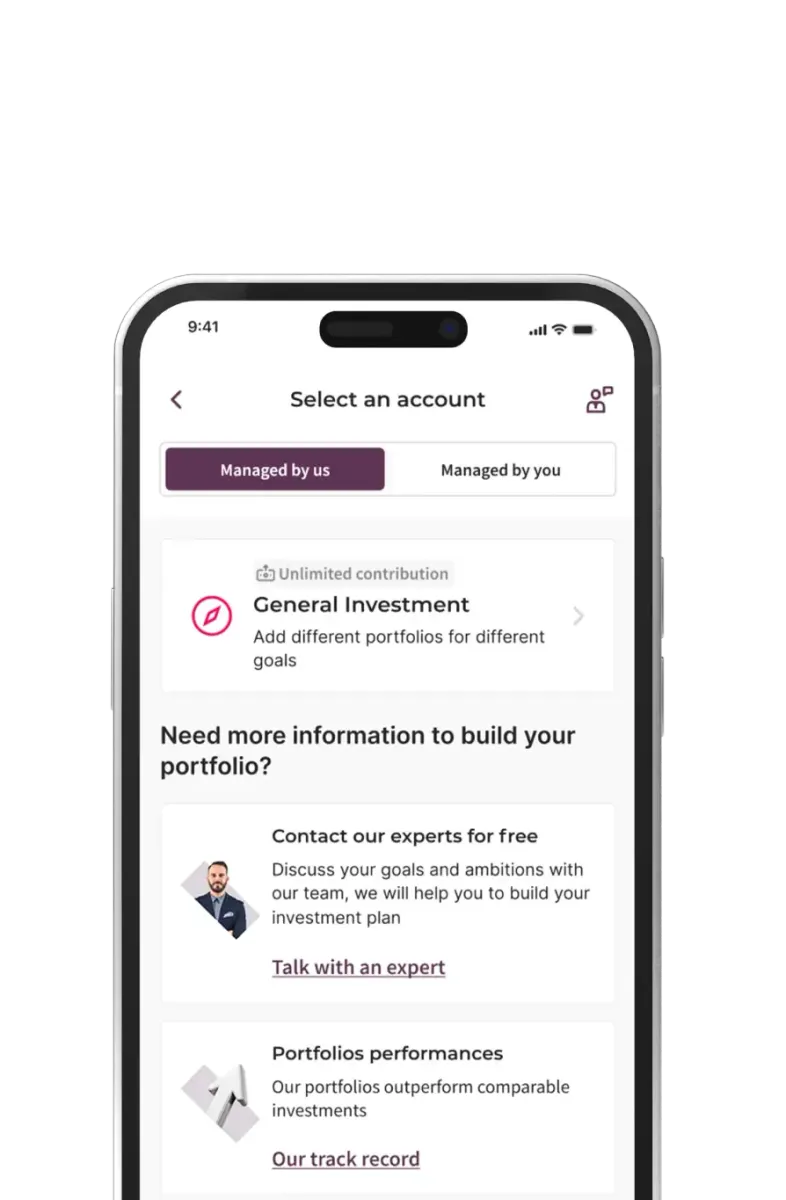

If you would like further explanations please speak to our investment adviser team.