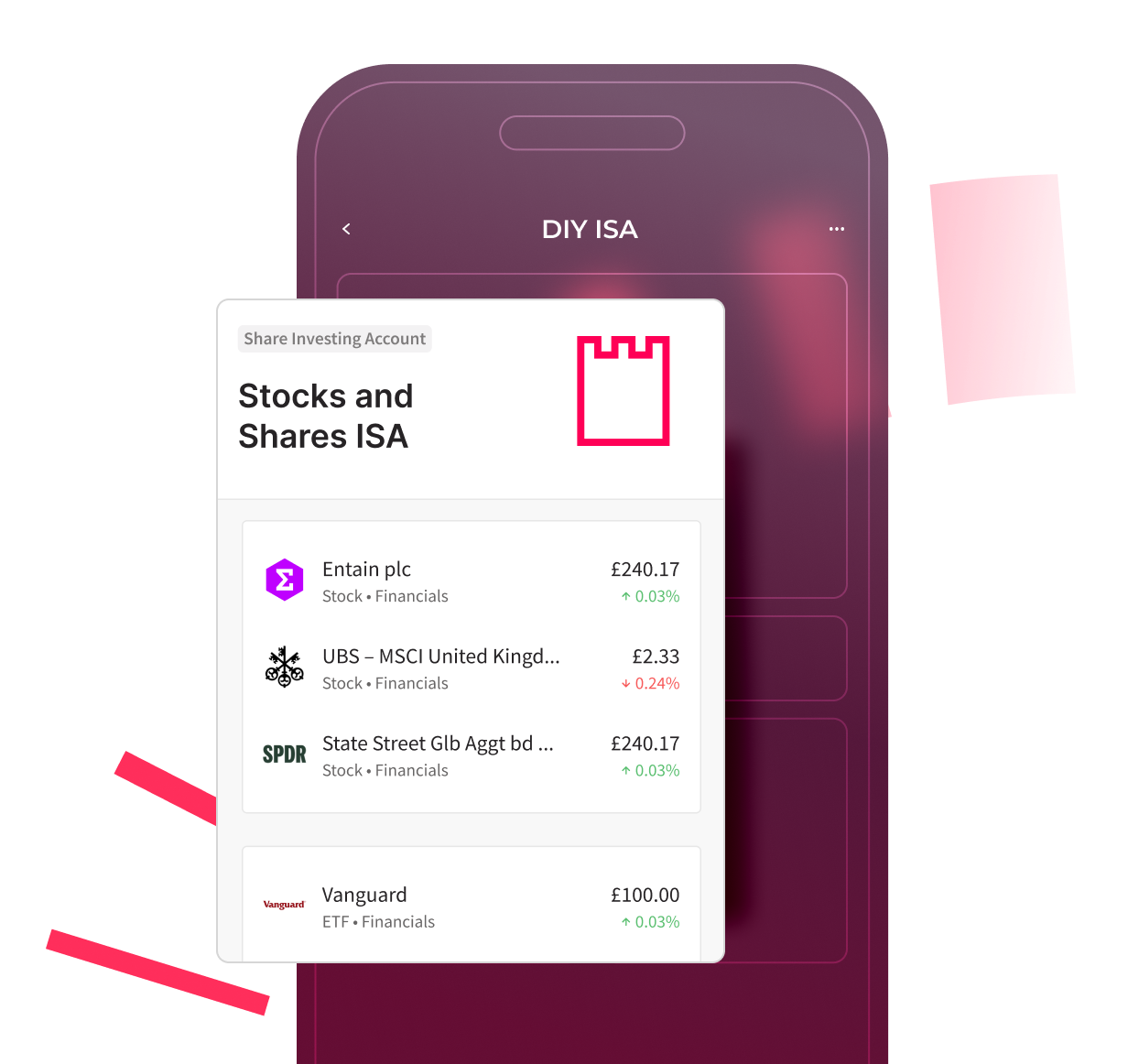

Invest your own way with a DIY Stocks & Shares ISA.

Our platform gives you access to 1,000+ assets including stocks, ETFs, bonds, and mutual funds.

Invest your own way with a DIY Stocks & Shares ISA.

Our platform gives you access to 1,000+ assets including stocks, ETFs, bonds, and mutual funds.

Create your ISATransfer a portfolioThe key benefits of a DIY ISA.

Full control over your investments

Choose and manage your own investments within your ISA wrapper.

Diverse investment options

Choose from over 1,000+ assets including stocks, ETFs, bonds, and mutual funds.

Personalised

Align your portfolio with your values and financial goals, one investment at a time.

Intelligent Analytics

Our integrated Analytics tool provides a comprehensive view and deeper insights for informed decision-making.

Expert guidance

Benefit from a consultant by your side throughout your investing journey.

The key benefits of a DIY ISA.

Choose and manage your own investments within your ISA wrapper.

Choose from over 1,000+ assets including stocks, ETFs, bonds, and mutual funds.

Align your portfolio with your values and financial goals, one investment at a time.

Our integrated Analytics tool provides a comprehensive view and deeper insights for informed decision-making.

Benefit from a consultant by your side throughout your investing journey.

A DIY ISA could be right for you if…

You want to build your own portfolio and manage it yourself.

You’re confident in making your own investment decisions.

You’re looking for a wide range of investment options within your ISA.

You want your investments to closely align with your values and goals.

Our experts are by your side.

Our dedicated consultants can guide and support you throughout your investing journey at no extra cost.

Book appointmentBook an appointment

What can you invest in?

Our Managed ISA can be personalised with different investment styles to align with your values and goals.

Stocks

Invest in a wide array of companies across various sectors and markets. Build a portfolio that aligns with your financial goals and risk tolerance, whether you’re seeking growth, income, or a balance of both.

Bonds

Diversify your portfolio with bonds, offering stability and a regular income stream through fixed-interest payments. Choose from a range of government and corporate bonds to tailor your investment strategy and manage risk.

ETFs

Immerse yourself in the dynamic world of ETFs. These versatile investment instruments can help diversify your portfolio efficiently, giving you exposure to entire markets, sectors, or asset classes in a single trade.

Mutual funds

Broaden your investment reach with our selection of mutual funds. Access professionally managed portfolios that provide exposure to a diverse array of markets and strategies, enabling a balanced and diversified investment approach.

Invest in a wide array of companies across various sectors and markets. Build a portfolio that aligns with your financial goals and risk tolerance, whether you’re seeking growth, income, or a balance of both.

Diversify your portfolio with bonds, offering stability and a regular income stream through fixed-interest payments. Choose from a range of government and corporate bonds to tailor your investment strategy and manage risk.

Immerse yourself in the dynamic world of ETFs. These versatile investment instruments can help diversify your portfolio efficiently, giving you exposure to entire markets, sectors, or asset classes in a single trade.

Broaden your investment reach with our selection of mutual funds. Access professionally managed portfolios that provide exposure to a diverse array of markets and strategies, enabling a balanced and diversified investment approach.

Our costs.

What you’ll pay

Total estimated costs

As your wealth grows, the Moneyfarm fee can reduce to 0.35%.

More on fees

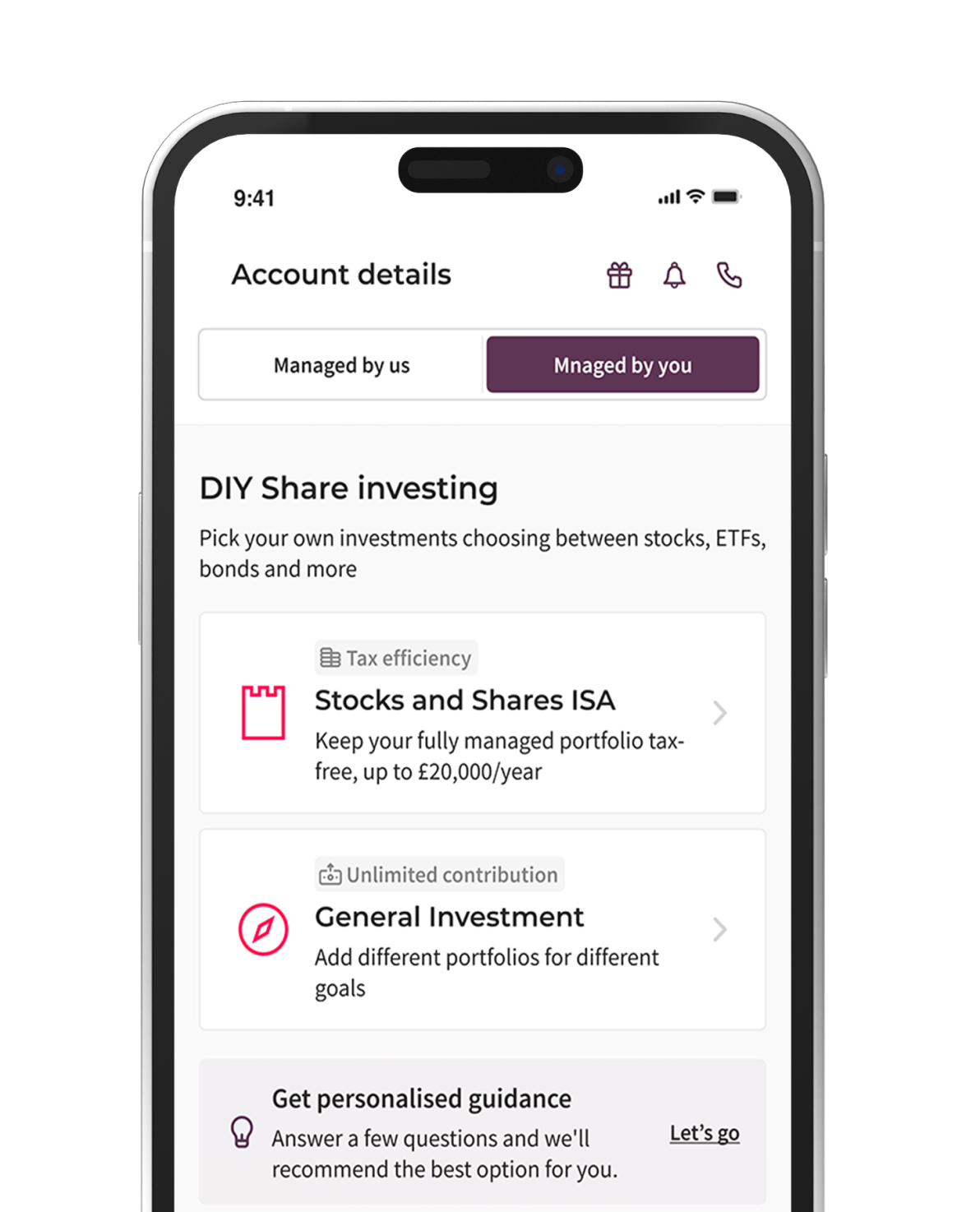

Get started in 3 simple steps.

On your own or with help from one of our consultants.

Choose an investment solution or let our questionnaire guide you.

Select the DIY Stocks and Shares ISA option and fill in your details.

Start building your portfolio with access to our research tools and expert insights.

Choose an investment solution or let our questionnaire guide you.

Select the DIY Stocks and Shares ISA option and fill in your details.

Start building your portfolio with access to our research tools and expert insights.