Build your wealth with confidence.

We make investing simpler and more accessible for everyone. Whatever your financial goals are, we can help you achieve them with confidence and peace of mind.

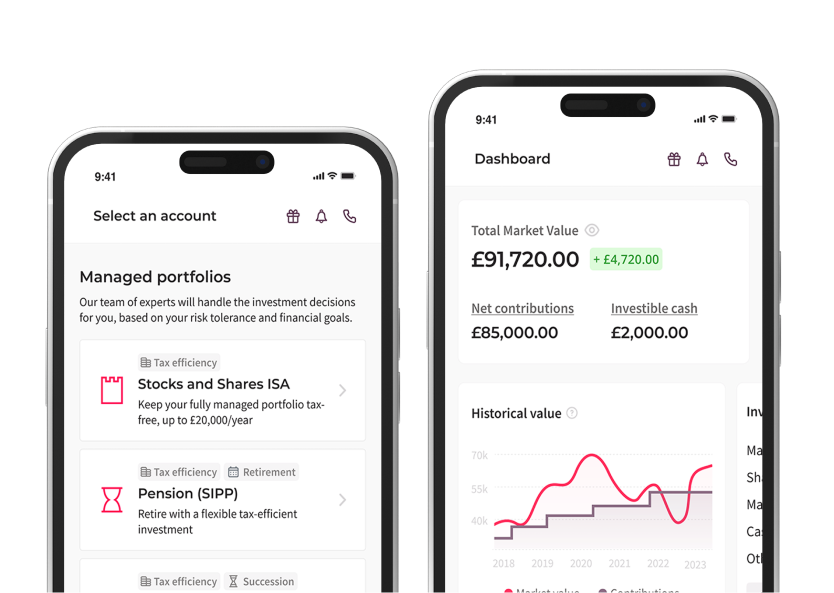

Get startedThe image is for illustrative purposes only and is not representative of any client's portfolio.

Build your wealth with confidence.

We make investing simpler and more accessible for everyone. Whatever your financial goals are, we can help you achieve them with confidence and peace of mind.

Get started

Get a cash boost of up to £3,000 when you transfer your pensions.

Offer valid until December 2nd.

Capital at risk. UK residents, 18+. T&Cs apply.

Invest in an expertly managed portfolio.

Our investment experts build and manage your portfolio, giving your wealth the best chance to grow.

Whether it’s an ISA, Pension or General Investment Account (GIA), we match your portfolio to your goals and risk profile, taking care of all the work for you.

As with all investing, your capital is at risk.

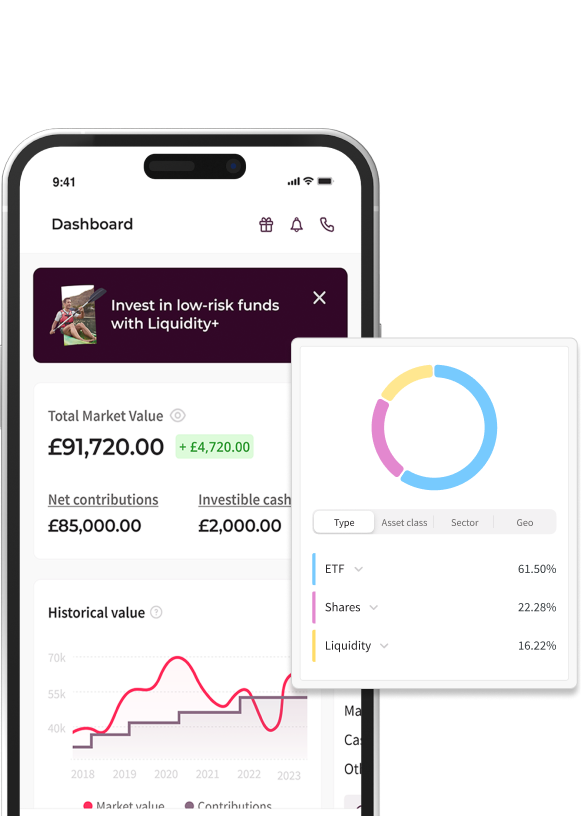

The image is for illustrative purposes only and is not representative of any client's portfolio.

Invest your own way.

Build your own portfolio on our Share Investing platform. Choose your own investments from a wide range of stocks, ETFs, bonds and mutual funds.

Enjoy the freedom to shape your strategy, backed by our team’s market insights and experience.

As with all investing, your capital is at risk.

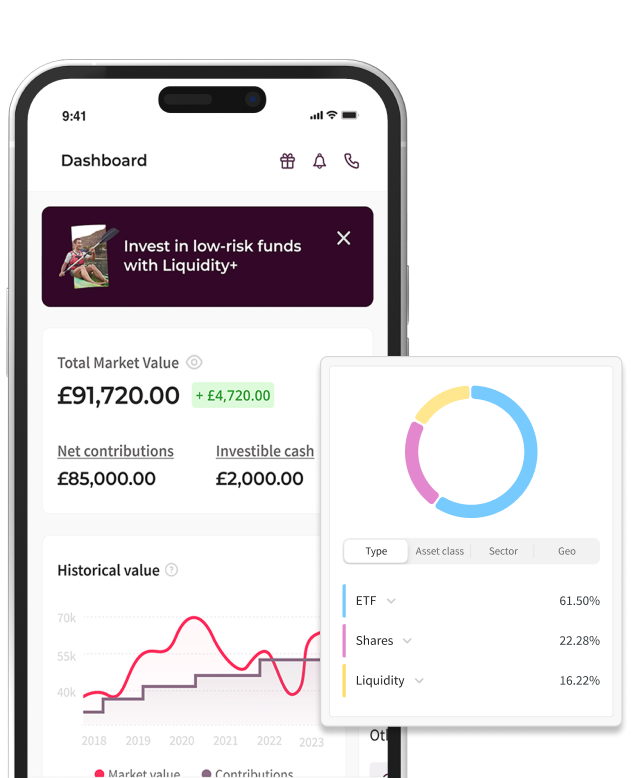

The image is for illustrative purposes only and is not representative of any client's portfolio.

Invest in an expertly managed portfolio.

Our investment experts build and manage your portfolio, giving your wealth the best chance to grow.

Whether it’s an ISA, Pension or General Investment Account (GIA), we match your portfolio to your goals and risk profile, taking care of all the work for you.

Let's get startedAs with all investing, your capital is at risk.

The image is for illustrative purposes only and is not representative of any client's portfolio.

Invest your own way.

Build your own portfolio on our Share Investing platform. Choose your own investments from a wide range of stocks, ETFs, bonds and mutual funds.

Enjoy the freedom to shape your strategy, backed by our team’s market insights and experience.

Create your portfolioAs with all investing, your capital is at risk.

The image is for illustrative purposes only and is not representative of any client's portfolio.

Our experts are by your side.

Our dedicated consultants can guide and support you throughout your investing journey at no extra cost.

Learn moreLearn moreWhat our clients say about us.

Trust is earned, not given. If you’re still unsure about Moneyfarm, discover what our clients are saying about us on Trustpilot.

Simpler investing starts here.

When you invest with us, we’re in it together. We’ll help you achieve your investment goals and turn your aspirations into a reality. Take the first step towards simpler, more accessible investing.

Let's get startedLet's get startedAs with all investing, your capital is at risk.

The image is for illustrative purposes only and is not representative of any client's portfolio.